December 09, 2020 | The Numbers Gang

No matter what you do, you are going to have some membership attrition each month on your unlimited wash plans. Some members will decide they aren’t using it enough to stay on. Others may have financial issues that compel them to cancel. And of course, there are those members whose credit cards are expired or declined and can’t be charged to renew their plan.

While you can’t save every member, there are things you can do to limit how many fall off, particularly when it comes to declined credit cards. Your point-of-sale (POS) system should have a feature that automatically retries credit cards daily for as many days as you specify. This can help you retain members who would otherwise be kicked off the plan because their credit cards were declined on the first try.

Let’s look at this feature in action and see its impact on a single month.

Rescuing Members…and Revenue

Like all car washes that automatically recharge monthly unlimited plans, this east coast car wash chain has its share of credit cards declined every month. Declines may happen because a card has expired, the customer has exceeded the credit limit or the bank has issued a security hold.

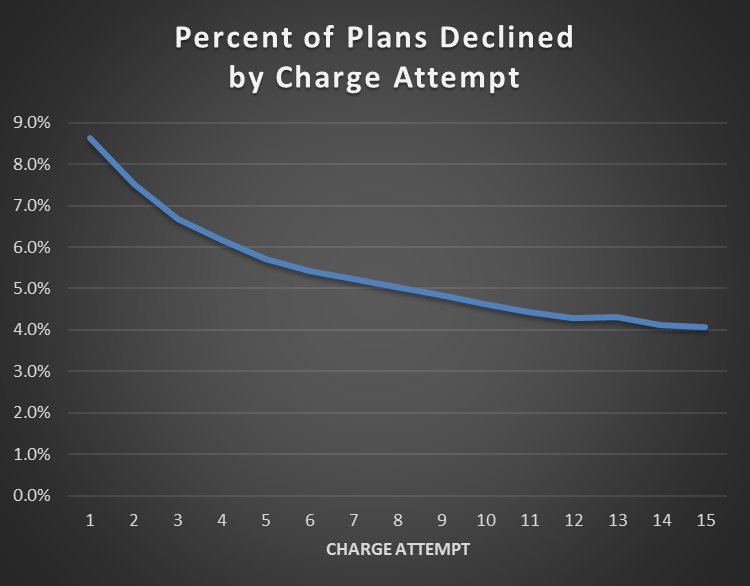

Being a DRB® SiteWatch point-of-sale user, this operator uses the Automatic Recharge Module® to automatically bill members’ credit cards to renew their plans monthly. During the one month the Numbers Gang analyzed, 8.6% of its monthly pass customer credit cards failed to recharge on the first try. If the chain had automatically canceled these customers across all locations, they would have lost 8,925 members, which would have been a $207,665 hit to the bottom line.

Fortunately, this business uses ARM’s Retry Feature to retry declined credit cards daily for 14 more days. As a result, 4,421 of the declined cards were eventually cleared; allowing the wash to retain nearly 50% of the pass customers that otherwise would have been lost. This resulted in $104,890 of “rescued revenue” that the wash earned from recharging cards that were initially declined.

Here are the numbers:

|

Wash Profile |

Express Exterior/Flex Sites on the East Coast |

|

Length of Time Offering Monthly Passes |

12 Years |

|

Number of Active Pass Holders |

108,606* |

|

Recharge Date |

Anniversary Date |

|

Type of Plan |

Unlimited Monthly |

|

Number of Credit Cards Declined On First Attempt |

8,925 (8.6% of total) |

|

Number of Declined Cards Approved After 3 Retries |

2,619 |

|

Number of Declined Cards Approved From 4-14 Retry Attempts |

1,802 |

|

Total Number of Declined Cards Ultimately Approved |

4,421 |

|

% of Declined Cards Ultimately Approved |

49.5% |

|

Total Number of Cards Declined After Exhausting All Retries |

4,220** |

|

% of Declined Cards Ultimately Declined |

4.1%** |

*Customers that join don’t see a recharge attempt that first month.

**Some customers discontinued their plan prior to the end of the retry period.

The Bottom Line

Car wash operators who do not retry credit cards after they have been declined the first time are missing an opportunity to retain valuable customers. This also shows that it pays to retry cards repeatedly rather than just once. Although the wash in our study recaptured most of its customers in the first four days, a good share (20%) of declined credit cards weren’t approved until 5 to 15 days of trying (retry attempts 4 through 14).

By retrying cards, the wash is also enhancing customer convenience and reducing frustration. The members who are successfully charged during the retry program won’t arrive at the wash to find their plan is canceled, and they won’t have to go through the hassle of signing up for the plan again.

It’s important to keep in mind that during the 14-day retry period, the car wash in our study had a 7-day grace period in place. This allowed customers with declined cards to continue using their unlimited plans during that time. Without this in place, you could end up recharging a customer’s credit card the day after they were prevented from using the monthly pass plan because a credit card was declined.

Your Move

Clearly, this shows that you should institute an automatic retry period if you don’t already have it in place. If you already have an automatic retry set up, you may want to consider whether you have it set for the right amount of time. If you notice that you have a high number of declines, you may consider extending your retry period.

The Numbers Gang recommends doing at least a 14-day retry. A large number of people are paid biweekly, so if their card is declined due to lack of funds, it may take them two weeks to have the necessary balance to have a successful retry.

Harold is our Sales Operations Manager. A graduate of the University of Akron with a degree in mathematics, Harold toiled for IBM before he joining DRB® in 1994. He has conducted numerous engineering studies on a wide variety of SiteWatch® products.

Harold is our Sales Operations Manager. A graduate of the University of Akron with a degree in mathematics, Harold toiled for IBM before he joining DRB® in 1994. He has conducted numerous engineering studies on a wide variety of SiteWatch® products. Brandy is a Data Analyst II and has been with DRB since 2009. She graduated from Kent State University with a degree in Mathematics. Brandy has conducted numerous data dives for DRB Customers, helping them understand the story their data is telling them.

Brandy is a Data Analyst II and has been with DRB since 2009. She graduated from Kent State University with a degree in Mathematics. Brandy has conducted numerous data dives for DRB Customers, helping them understand the story their data is telling them.