February 28, 2019 | Brett Meinberg

If you’re hoping to sell your car wash business in the next few years, the time to start preparing is now.

A number of car wash owners are deciding to sell their businesses as the number of potential buyers increases in this hot market. In particular, consolidators have gotten into the game, helping to drive up the sale prices of these businesses. This is providing a more profitable exit strategy than was previously available to operators.

Even if you’re not ready to take the leap right now, you want to start working to put your business in the best position for a future sale. This process should start at least three years in advance, if not five.

Why so much time? Well, there’s a lot more that goes into selling a car wash business than you may think. Some of those things affect how much you can get out of your business, and others impact how quickly and smoothly the process goes.

Here are some things to keep in mind as you consider the sale of your business.

Get Your Monthly Wash Plans in Order

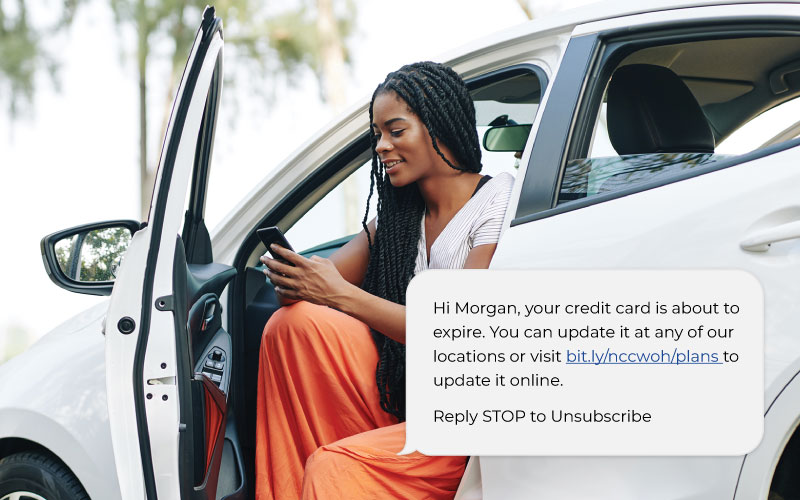

First things first: If you don’t have monthly wash plans, stop reading this and get one set up now. Seriously. The biggest threat to the car wash industry is the weather. The recurring revenue provided by monthly wash plans offsets that risk. That’s why it’s is one of the biggest things consolidators look at when deciding which businesses to acquire and how much to offer.

First things first: If you don’t have monthly wash plans, stop reading this and get one set up now. Seriously. The biggest threat to the car wash industry is the weather. The recurring revenue provided by monthly wash plans offsets that risk. That’s why it’s is one of the biggest things consolidators look at when deciding which businesses to acquire and how much to offer.

If you already have plans in place, now is the time to revive your efforts to expand your membership. At least 20-40% of your revenue should come from monthly plans.

Take a hard look at your plan offerings. Are they priced right? You should base pricing on the assumption customers will wash 3-4 times a month. Don’t try to pad the numbers to cover customers who wash more often. If you price plans too high, you’ll have a hard time getting members. Also, make sure plans are easy to understand and conveyed in a simple manner on your menu board.

Next, you’ll want to create a repeatable, dedicated sales process. That doesn’t mean simply offering bonuses or other incentives for selling plans. Employees need to be trained on sales just like they are on loading processes and chemicals. Sales can and should be coached, taught and planned out.

Boost Your EBITDA

In addition to increasing the number of monthly plans, you’ll want to do whatever else you can to improve your EBITDA (Earnings Before Interest, Tax, Depreciation and Amortization). Consolidators buy based on multiples of EBITDA.

Don’t wait for the buyers to come in and improve your business. Consolidators look at a three-year history, so start now. Cut costs. Hire well. Improve curb appeal and the general customer experience, even if that means investing in new technology or better equipment. Anything you can do to bring in more revenue will improve your selling price.

Cross Your T’s, Dot Your I’s

You should always make sure that you are in compliance with all applicable laws, but sometimes in business, things can fall through the cracks. Now is not that time. Your business will be under extra scrutiny, so it’s more important than ever to run a clean shop.

Make sure you are PCI compliant. Check to ensure all employee paperwork is in order, including I-9s. If there are any lingering employee issues, such as Workers’ Comp or EEOC claims, get them cleared up. These types of things can make a buyer think twice or at the very least delay the sale.

Prepare Paperwork

During the due diligence period, the buyer is going to have an extensive list of documents and information you will need to present, such as a 3-year financial history, employee information, easement, liens, etc. This list will likely be even more extensive if you’re selling to a consolidator.

This process can be extremely stressful and time-consuming, so gathering the required items little-by-little over time will make it more manageable. It also helps ensure that if you are missing an item, you’ll have time to get it and not hold up the purchase process.

While you’re compiling that information, it’s a good time to review all of your loan and financing information (early payment fees, payoff timing, liens, etc.). These factors can impact the sale.

Involve your employees

Car wash operators often want to keep employees in the dark until the sale is complete, worrying that if they clue them in too early, they will lose valuable staff. This strategy can often backfire.

Obviously, it’s important to keep many details of the sale private, but provide as much information as you can, especially to your key employees. Car washes are often like families, so employees can feel betrayed or blindsided when they aren’t included, making them more likely to leave. On the flip side, if you are transparent, employees may be more likely to see the opportunities that the sale might provide them, such as the ability to take on new positions or transfer.

Also, make sure your employees are set up for future success under the new owners. You’ll especially want to make sure you negotiate well for your top people to give them peace of mind that they’ll be able to stay after the transition.

Plan Your Next Step

What are you going to do once your business is sold? Will you ride off into the sunset of retirement, or do you want to continue working? If it’s the latter, you have a number of options. You could stay on and continue to run the wash without the stress of ownership. In that case, you’ll want to consider that when selecting a buyer. Make sure it’s a company you’ll be comfortable working with. Or maybe you want to open a new car wash in another region or try a whole new industry altogether.

What are you going to do once your business is sold? Will you ride off into the sunset of retirement, or do you want to continue working? If it’s the latter, you have a number of options. You could stay on and continue to run the wash without the stress of ownership. In that case, you’ll want to consider that when selecting a buyer. Make sure it’s a company you’ll be comfortable working with. Or maybe you want to open a new car wash in another region or try a whole new industry altogether.

The world is your oyster, but you need to have a plan.

Get Ready

If you are even considering selling your car wash business, it’s time to get ready. Having a firm plan in place will ensure a bright future for both you and your employees.